Optimize your financial management with Great Plains Accounting Software. Streamline operations for business success

In today’s fast-paced business world, effective financial management is crucial for the success and sustainability of any organization. One tool that has proven invaluable in this regard is the Great Plains Accounting Software.

In this comprehensive guide, we will take a deep dive into the world of Great Plains Accounting Software, exploring its features, benefits, and how it can help you master financial management for your business.

Financial management lies at the heart of every successful business. It involves making informed decisions about budgeting, investments, and cash flow. Great Plains Accounting Software is a powerful tool designed to simplify these tasks, providing businesses with the tools they need to thrive in today’s competitive landscape.

Understanding Great Plains Accounting Software

What Is Great Plains Accounting Software?

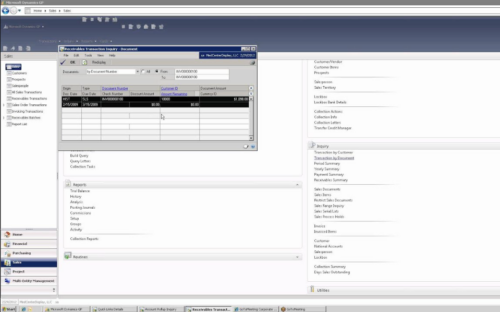

Great Plains Accounting Software, often referred to as Microsoft Dynamics GP, is an enterprise resource planning (ERP) solution designed to streamline financial operations. It offers a comprehensive suite of financial management tools, including general ledger, accounts payable, accounts receivable, payroll, and more.

A Brief History

Originally developed by Great Plains Software, the software gained immense popularity and was eventually acquired by Microsoft in 2001. Since then, it has continued to evolve, incorporating cutting-edge features and technologies.

Key Features and Functionality

– Streamlined Financial Reporting

One of the standout features of Great Plains is its robust reporting capabilities. It allows users to generate detailed financial reports quickly, providing valuable insights into the company’s financial health.

Streamlined financial reporting is a critical aspect of modern financial management. It involves the efficient and organized process of gathering, analyzing, and presenting financial data to facilitate informed decision-making within an organization. This practice is essential for businesses of all sizes, as it provides a clear and accurate snapshot of the company’s financial health, enabling leaders to make strategic choices with confidence.

Here are some key points to understand about streamlined financial reporting:

Data Accuracy: Streamlined financial reporting relies on accurate and up-to-date financial data. This data encompasses various aspects of a company’s finances, including income, expenses, assets, liabilities, and cash flow. Accurate data is the foundation upon which effective financial reporting is built.

Automation: In today’s digital age, manual data entry and calculations are time-consuming and prone to errors. Streamlined reporting often involves the automation of data collection and processing. This not only reduces the risk of errors but also saves valuable time for finance professionals.

Timeliness: Timely reporting is crucial. Businesses need access to financial reports on a regular basis to make informed decisions. Streamlined reporting systems are designed to generate reports quickly, allowing for timely analysis and action.

Accessibility: Financial reports should be accessible to key stakeholders within the organization, including executives, managers, and department heads. Streamlined reporting solutions often include user-friendly interfaces that enable easy access to relevant financial data.

Customization: Every business is unique, and its financial reporting needs may vary. Streamlined reporting systems can often be customized to suit the specific requirements of a company. This customization allows businesses to focus on the metrics and KPIs (Key Performance Indicators) that matter most to their operations.

Visualization: Effective reporting goes beyond rows of numbers. Visualization tools, such as graphs and charts, can help stakeholders better understand complex financial data. Visual representations make it easier to identify trends, patterns, and areas that require attention.

Compliance: For publicly traded companies and those subject to regulatory oversight, streamlined financial reporting also includes compliance with accounting standards and legal requirements. Compliance ensures transparency and builds trust with investors and regulators.

Strategic Insights: Streamlined financial reporting is not just about presenting historical data; it’s also about providing insights that can drive strategic decision-making. This may include forecasting future financial performance, identifying cost-saving opportunities, or assessing the financial impact of different business strategies.

– Integration Capabilities

Great Plains seamlessly integrates with other Microsoft products like Excel and Word, simplifying data exchange and enhancing productivity.

Integration capabilities refer to a software system’s ability to seamlessly connect and interact with other software applications and systems. In the context of financial management and accounting software, such as Great Plains Accounting Software, integration capabilities are crucial for enhancing efficiency, accuracy, and productivity within an organization. Here, we’ll delve into the importance and benefits of integration capabilities in accounting software.

Streamlined Data Flow: Integration capabilities enable data to flow seamlessly between different software systems. For financial management, this means that data related to transactions, invoices, expenses, and more can be automatically transferred to and from other systems, such as CRM (Customer Relationship Management) software or payroll systems. This eliminates the need for manual data entry, reducing errors and saving valuable time.

Enhanced Productivity: When accounting software integrates with other business tools, it reduces the need for duplicate data entry and manual reconciliation. This, in turn, boosts productivity as employees can focus on more value-added tasks rather than spending time on data input and verification.

Real-Time Insights: Integration allows for the retrieval of real-time data from various sources. This means that financial professionals can access up-to-the-minute financial information, providing a more accurate and current view of the organization’s financial status. Real-time insights are invaluable for making timely and informed decisions.

Improved Accuracy: Integration reduces the risk of data errors associated with manual data entry. When data is automatically synchronized between systems, there is a lower chance of discrepancies or data inconsistencies, ensuring that financial records are accurate and reliable.

Better Decision-Making: Integration capabilities enable financial data to be combined with data from other departments, such as sales, marketing, and operations. This comprehensive view of data allows for better decision-making and strategic planning. For example, sales data can be integrated with financial data to assess the profitability of specific products or customer segments.

Efficient Workflows: Integration supports the automation of workflows. For example, when a sales team generates an invoice, integration can trigger the automatic creation of corresponding accounting entries and update inventory levels. This streamlines business processes, reduces manual intervention, and minimizes delays.

Enhanced Customer Experience: In businesses where customer data is essential, integration allows for a holistic view of customer interactions. This means that financial professionals can access customer history, outstanding payments, and billing information within the accounting software, leading to improved customer service and relationship management.

Scalability: As businesses grow, their software needs may change. Integration capabilities make it easier to add new software solutions to the existing ecosystem without disrupting operations. This scalability ensures that the accounting software can adapt to the evolving needs of the organization.

– Customization Options

Businesses can tailor Great Plains to suit their specific needs. Whether it’s creating custom reports or adding unique data fields, the software is highly flexible.

Customization options in accounting software refer to the ability to tailor the software to meet the specific needs and requirements of a business. This flexibility is crucial because every organization has unique financial processes, reporting preferences, and operational workflows. Here, we’ll delve into the significance and benefits of customization options in accounting software.

Adaptability to Business Needs: Customization allows businesses to adapt accounting software to their specific industry, size, and operational intricacies. Whether a company operates in manufacturing, healthcare, retail, or any other sector, customization ensures that the software can address industry-specific financial requirements.

Tailored Reporting: Every organization has its own set of key performance indicators (KPIs) and reporting preferences. Customization options enable users to create tailored reports that focus on the financial metrics that matter most to their business. This ensures that financial data is presented in a meaningful and actionable way.

Unique Data Fields: Some businesses need to track data that may not be part of the standard accounting software. Customization allows the addition of unique data fields, ensuring that the software can capture and process all relevant financial information.

Workflow Automation: Customization extends to automating workflows to match the company’s specific processes. For example, approval processes for expense reports or purchase orders can be customized to align with the organization’s hierarchy and approval requirements.

User Interface (UI) Personalization: Accounting software often includes options for personalizing the user interface. Users can arrange dashboards, menus, and data displays to suit their preferences, making it easier to access the most frequently used features.

Compliance and Regulations: Different industries may have specific regulatory requirements. Customization options allow organizations to configure the software to comply with industry-specific regulations, ensuring accurate financial reporting and adherence to legal requirements.

Scalability: As businesses grow, their accounting needs may evolve. Customization ensures that the software can scale with the organization. New features, modules, or reporting structures can be added without the need for a complete software overhaul.

Integration with Existing Systems: Customization facilitates seamless integration with existing software systems. This is particularly important for organizations that use other business tools, such as CRM or inventory management systems. Customization ensures that data flows smoothly between systems.

User Roles and Permissions: Customization allows administrators to define user roles and permissions. This ensures that employees have access only to the parts of the accounting software that are relevant to their roles, enhancing security and data privacy.

Cost Efficiency: By tailoring the software to meet specific needs, businesses can avoid unnecessary features or complexities that can drive up costs. Customization allows for a more cost-effective solution that focuses on what’s essential.

Advantages of Using Great Plains Accounting Software

Enhanced Accuracy

With automation and built-in checks and balances, Great Plains reduces the likelihood of errors in financial data, ensuring accurate financial records.

Improved Efficiency

The software streamlines repetitive tasks, freeing up valuable time for finance teams to focus on strategic activities.

Scalability for Growing Businesses

Great Plains can scale with your business, making it an ideal choice for startups and established enterprises alike.

Getting Started with Great Plains

Installation and Setup

Setting up Great Plains is a straightforward process. Users can choose between on-premises or cloud-based deployment options, depending on their preferences.

User Training

Proper training is essential to make the most of Great Plains’ capabilities. Many training resources are available to ensure users can navigate the software efficiently.

Utilizing Great Plains for Financial Management

Managing Accounts Payable

Great Plains simplifies the accounts payable process, allowing businesses to manage invoices and payments with ease.

Accounts Receivable

Tracking and managing receivables become more efficient, ensuring timely payments from customers.

Budgeting and Forecasting

The software aids in budget creation and provides forecasting tools, enabling businesses to plan for the future effectively.

Security and Data Protection

Ensuring Data Security

Protecting financial data is paramount. Great Plains offers robust security features to safeguard sensitive information.

Data Backup and Recovery

In the event of data loss, the software’s backup and recovery mechanisms ensure minimal disruption to operations.

Troubleshooting Common Issues

Error Handling

Even the best software encounters occasional issues. Great Plains provides troubleshooting tools and resources to address problems promptly.

Software Updates

Regular updates keep Great Plains current and secure. Staying up-to-date is essential for optimal performance.

Great Plains vs. Competitors

A Comparison

We compare Great Plains Accounting Software to other popular ERP solutions, helping you make an informed choice for your business.

Choosing the Right Accounting Software

Selecting the right accounting software is a critical decision. We provide guidance on factors to consider during your selection process.

Success Stories

Real-World Examples

Explore real success stories of businesses that have harnessed the power of Great Plains to achieve financial excellence.

How Great Plains Transformed Businesses

Discover how Great Plains has positively impacted businesses across various industries.

Future Trends and Developments

As technology advances, so does financial management software. We delve into the future trends and developments in the world of accounting software.

FAQs

Is Great Plains Accounting Software suitable for small businesses?

Absolutely! Great Plains can scale to meet the needs of small and large businesses alike.

How often should I update my Great Plains software?

Regular updates are recommended to ensure you have the latest features and security patches.

Can I access Great Plains Accounting Software remotely?

Yes, you can choose cloud-based deployment for remote access.

Are there any industry-specific versions of Great Plains?

Yes, there are industry-specific modules available to cater to various business sectors.

What kind of support options are available for Great Plains users?

Microsoft offers a range of support options, including documentation, online resources, and customer support.

Conclusion

Mastering financial management is essential for any business aiming for growth and sustainability. Great Plains Accounting Software simplifies this complex task, making it a valuable asset for businesses of all sizes.